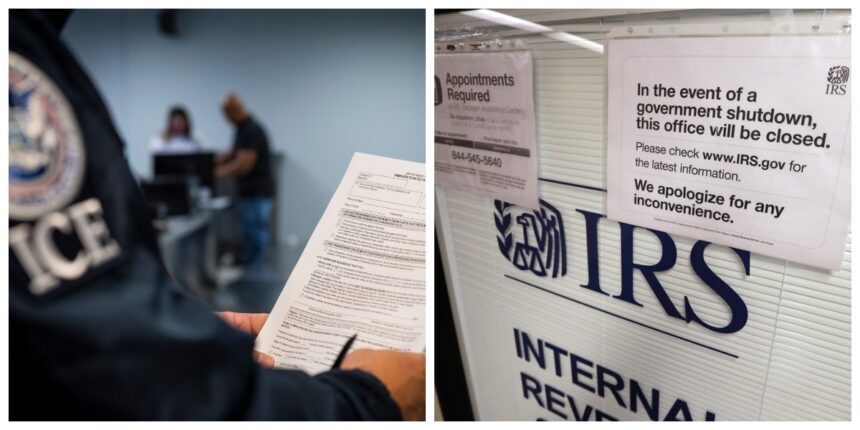

In a decision that has generated concern among migrant advocates, a federal judge in the District of Columbia, Dabney Friedrich, refused to block the agreement between the Internal Revenue Service (IRS) and the Department of Homeland Security (DHS) that allows immigration authorities to access tax data of people subject to deportation in the United States.

The ruling, issued Monday by Friedrich – who was appointed by President Donald Trump – represents a new legal victory for his administration, which since January 2025 has stepped up policies aimed at speeding up deportations and restricting benefits to migrants without legal status.

Agreement between IRS and Immigration

According to DHS sources cited by the Washington Post, the initial agreement provides for consultations on approximately 2 million tax records.

The ultimate goal would be to track information on up to 7 million individuals who have used an Individual Taxpayer Identification Number (ITIN) to file taxes.

This is a common practice among undocumented immigrants seeking to comply with their tax obligations without having a Social Security number.

The agreement is described by the federal government as a tool to detect threats to national security.

According to Tricia McLaughlin, DHS Under Secretary for Public Affairs, it will also serve to identify migrants receiving federal public benefits.

Internal IRS consequences

Several pro-immigrant organizations, including Centro de Trabajadores Unidos, Somos Un Pueblo Unido and Inclusive Action for the City, sued the government.

They argued that the agreement violated the taxpayer confidentiality law by allowing the use of tax information without a court order.

The ruling represents a new legal victory for the Donald Trump administration

QueOnnda.com

However, the judge concluded that the plaintiffs did not demonstrate a clear violation of the law.

As a result of the settlement, the then acting director of the IRS, Melanie Krause, resigned.

This after pointing out that the final pact did not coincide with the initial draft it had approved.

This is the third IRS departure since January of this year.

For more information, visit QueOnnda.com.