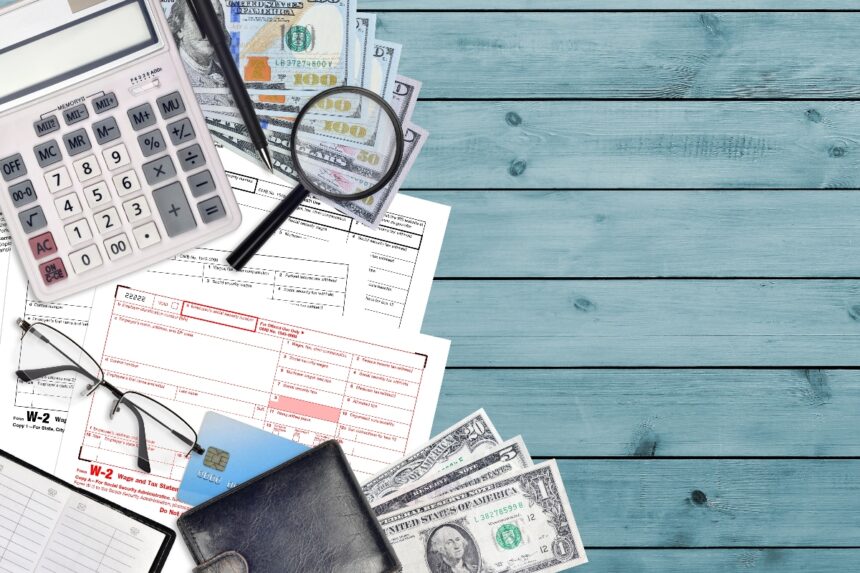

Winning the lottery is a dream come true, but it can also become a headache if you don’t consider taxes.

The IRS (Internal Revenue Service) takes a significant portion of your lottery winnings, and here at QueOnnda.com we explain what to expect and how to prepare.

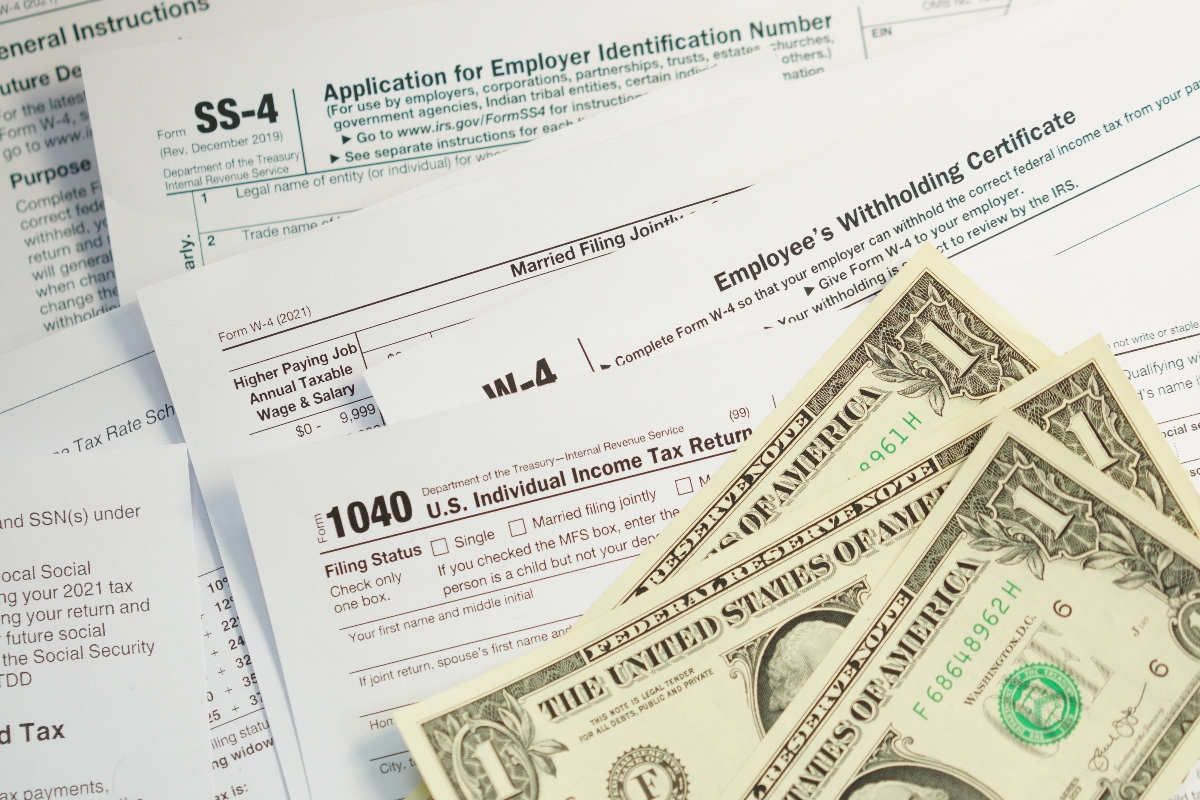

1. Federal taxes

The IRS automatically withholds 24% of your winnings when you claim your lottery prize. However, this is just the beginning:

If your earnings are very high, you could pay up to 37% tax.

For example, if you earn $1 million, $240,000 will be withheld immediately, but you may owe another $130,000 when you file your taxes.

Winning the lottery is a dream come true, but it can also turn into a headache

QueOnnda.com

2. State taxes

In addition to federal taxes, many states also tax lottery winnings. Some examples:

New York: up to an additional 10.9%.

California: no state tax on lottery winnings.

Consult a tax advisor to find out how this affects your situation.

3. Choice of payment

One-time payment: You receive less money in general, but all of it immediately.

Annual payments: Allows you to spread your earnings over the years, which can reduce your annual tax burden.

Your decision will depend on your financial plan and your long-term goals.

4. Tips

Hire an accountant or financial advisor specialized in large fortunes.

Establish an emergency fund and pay your debts.

Invest your earnings wisely to generate passive income.

5. Resign yourself!

Winning the lottery is exciting, but the IRS keeps a significant portion.

24% of your winnings are automatically withheld when you claim your prize. However, you may pay up to 37% on your tax return if your winnings exceed certain limits.

For example, earning $1 million implies an immediate withholding of $240,000, but you could owe an additional $130,000.

In addition, state taxes vary: New York charges up to 10.9%, while California does not tax these prizes.

You must also choose between lump sum (less money, but immediate) or annual payments, which reduces the annual tax burden.

Financial advice, creating an emergency fund and planning smart investments are recommended.