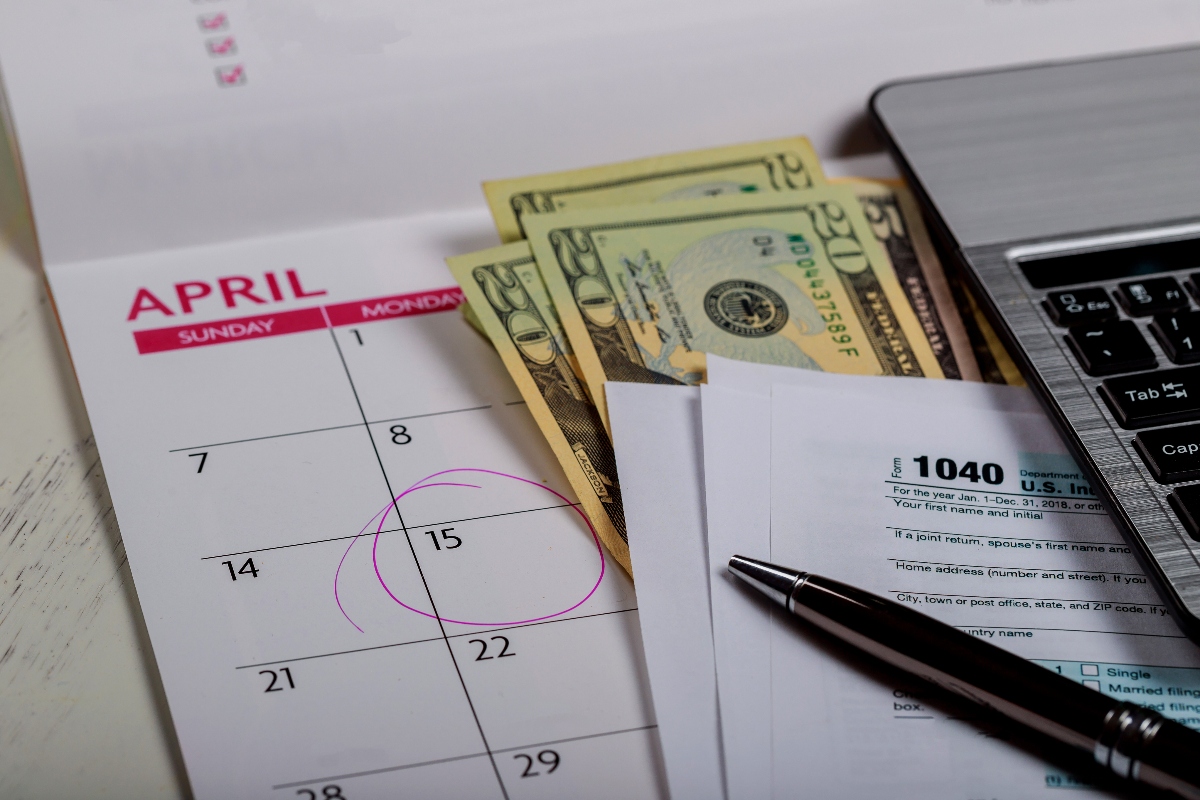

“Many Latino taxpayers in the United States do not claim tax refunds to which they are entitled, losing thousands of dollars each year,” warns the Internal Revenue Service (IRS).

Can you imagine receiving more than $7,000 from the government? This is possible thanks to the Earned Income Tax Credit (EITC), a benefit that, according to the Center on Budget and Policy Priorities (CBPP), helps millions of working families. The Hispanic community, which represents a significant portion of the nation’s workforce, could be leaving money on the table. The question is: do you qualify for this rebate? Keep reading, because QueOnnda.com explains how to access this golden opportunity.

What is the EITC?

The Earned Income Tax Credit (EITC) is a tax benefit for workers with low to moderate incomes.

According to the IRS, in 2023, the maximum credit may exceed $7,430 for families with three or more children.

This credit is deducted from the amount of taxes owed and could result in a refund if it exceeds what you owe.

The best: You don’t need to have children to qualify, although the amount is higher for those with dependents.

2. Who qualifies?

The main requirements to qualify for this rebate, according to the website of IRS.gov, are:

Have income from work (employment, self-employment or farms).

Have a valid Social Security number.

Be a U.S. citizen or legal resident for the entire year.

Earn no more than the IRS limits (up to $63,398 by 2023 if filing jointly and with three children).

Even if you are not required to file a tax return, you should do so to claim this credit!

Can you imagine receiving more than $7,000 from the government?

QueOnnda.com

3. How to request your check

To obtain this refund, simply file your tax return and claim the EITC.

The IRS offers free help through its VITA (Volunteer Income Tax Assistance) program, available in Spanish.

In addition, platforms such as MyFreeTaxes.com, supported by United Way, allow you to file taxes for free if you meet certain criteria.

4. Avoid common mistakes

The IRS reports that the most frequent errors include:

Income reported incorrectly.

Claiming ineligible children.

Marital status for tax purposes incorrectly selected.

Double check everything or consult with a professional – it could mean the difference between receiving or losing thousands of dollars!

A refund of up to $7,000 could be waiting for you.

With verified information from the IRS and CBPP, it is clear that the Earned Income Tax Credit (EITC) is an invaluable opportunity for the Hispanic community.

Don’t let this money go to waste! Just by filing your tax return and verifying that you meet the criteria, you could receive a check that will make a difference in your finances.