Finding affordable and reliable auto insurance is a priority for many Hispanic families in the United States. According to the Insurance Information Institute (III), the average annual cost of auto insurance in 2025 is $1,682, but there are more affordable options that offer good coverage without breaking your budget.

Here are five insurers with the best rates and customer service, as rated by J.D. Power, NerdWallet and The Zebra.

1. Geico

Average cost: From $1,250 per year (according to The Zebra).

Discounts: Responsible drivers, students, military and special affiliations.

Strengths: Fast online quotation and flexible coverage.

Key fact: Geico consistently ranks as one of the most affordable insurers in the U.S., according to J.D. Power 2025.

2. State Farm

Average cost: From $1,390 per year.

Discounts: For multiple cars, safe driving record and combined policies (auto + home).

Strengths: Network of bilingual agents and highly valued customer service.

Key Fact: State Farm is the most popular insurer among Hispanic drivers, thanks to its extensive network of Spanish-speaking agents, according to Forbes Advisor.

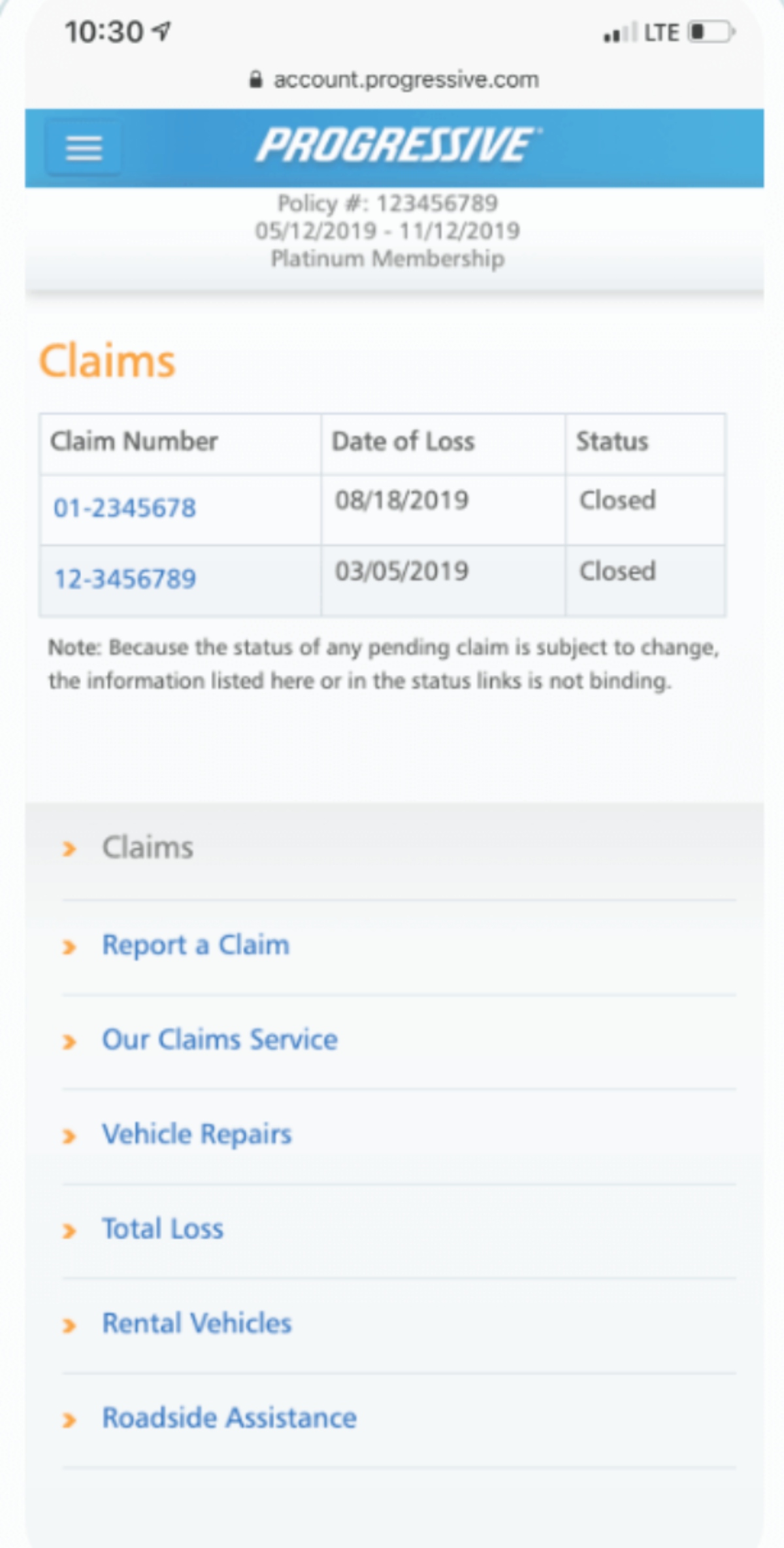

3. Progressive

Average cost: From $1,320 per year.

Discounts: Low vehicle usage, safe driver and annual payment.

Strengths: “Name Your Price” tool, which adjusts coverage to your budget.

Key fact: Progressive is a leader in highly customized insurance, allowing drivers to tailor their policies to their needs.

4. Allstate

Average cost: From $1,460 per year.

Discounts: “Drivewise” program, which offers additional savings for safe driving.

Strengths: Focus on protection and roadside assistance.

Key Fact: According to J.D. Power 2025, Allstate stands out for its excellent customer service and comprehensive coverage options.

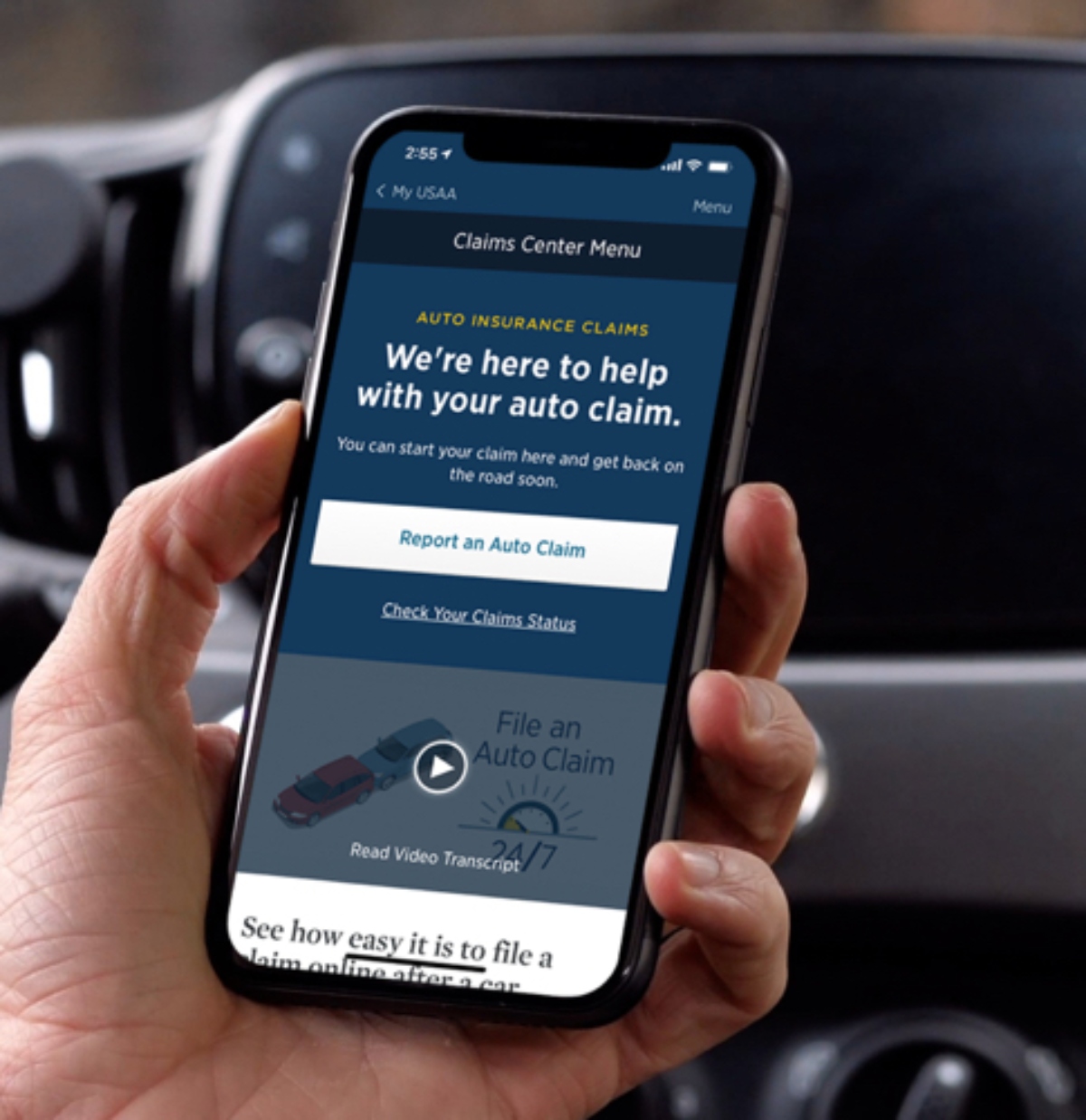

5. USAA

Average cost: From $1,200 per year.

Requirements: Exclusively for active and veteran members of the military and their families.

Strengths: Low rates and service highly valued by its customers.

Key Fact: USAA consistently receives top auto insurance satisfaction ratings (J.D. Power 2025), but is limited to the military community.

How to choose the best one?

To find the best option for your budget and needs, follow these tips:

Compare prices and coverage at sites such as NerdWallet, The Zebra and Policygenius.

Check customer reviews on Trustpilot and Better Business Bureau (BBB).

Ask about discounts, as many insurers offer reduced rates for good drivers, students and loyal customers.

Key Fact: According to the Insurance Information Institute, comparing options can help you save up to 40% on your annual policy.

Having a good car insurance doesn't have to be expensive

QueOnnda.com

For more Autos news, visit QuéOnnda.com.