If you ever thought that investing was exclusively for the wealthy, it’s time to rethink that idea. Today, starting a path in the investment world is possible with minimal amounts, allowing anyone, regardless of their income, to build a more solid financial future.

At QuéOnnda, we are committed to providing clear, accurate and up-to-date information so that the U.S. Hispanic community can take advantage of these opportunities in a smart and safe way.

Why should you invest?

Investing is not only about generating additional income, but also about creating a financial base that protects your savings against inflation and allows you to achieve long-term goals, such as buying a home, saving for education or a decent retirement.

According to U.S. Census Bureau data, Hispanic participation in the U.S. economy has been increasing, however, a high percentage is still not taking advantage of available investment opportunities.

Investing early and steadily is a proven strategy for harnessing the power of compound interest and diversifying income sources.

Opportunities for the Hispanic community

Growing financial inclusion has allowed more and more members of the Hispanic community to access investment tools and resources.

This trend is especially relevant in an environment where the global economy and digitalization facilitate access to markets previously reserved for large-cap investors.

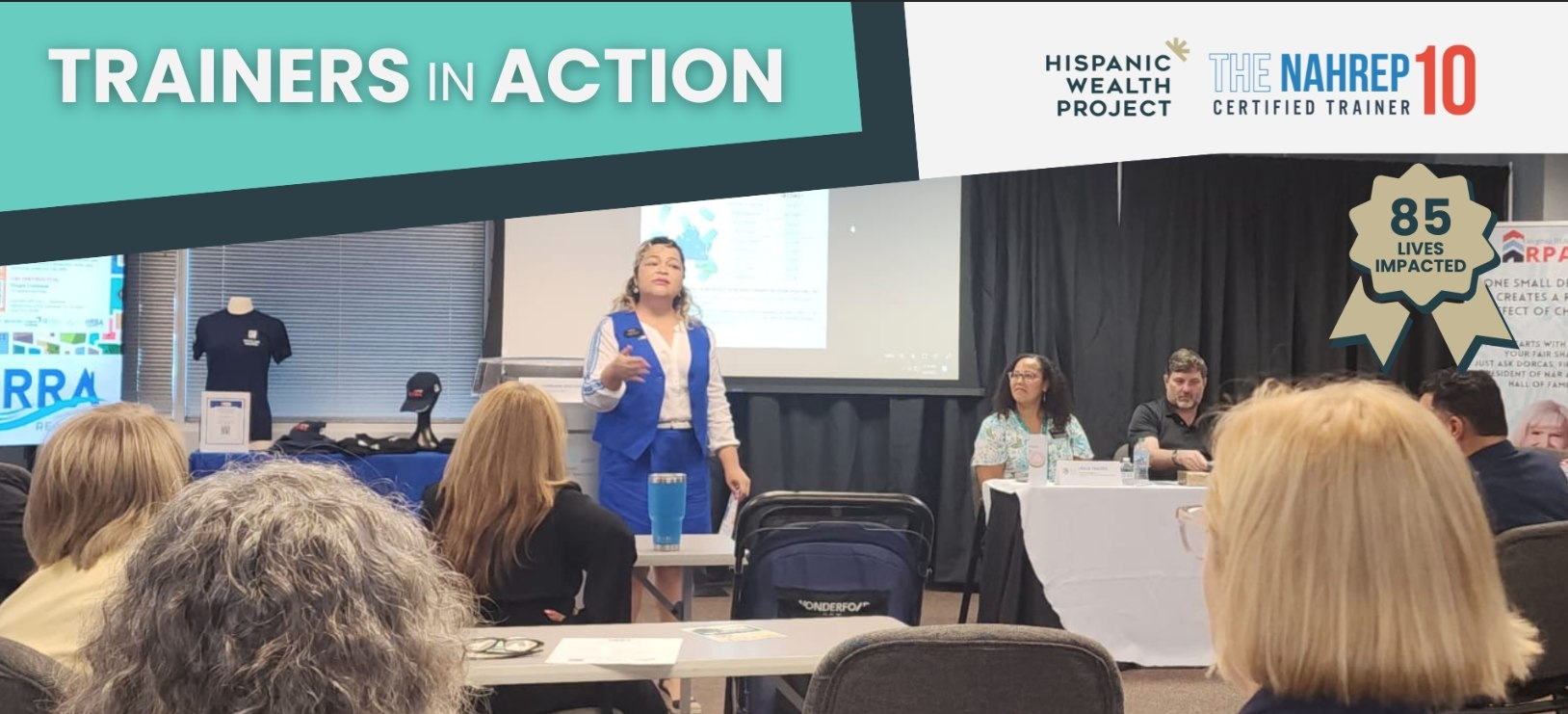

Organizations like the Hispanic Wealth Project are committed to providing financial education and resources tailored to the realities of the Hispanic community, helping to break down barriers and encourage informed decision making.

Platforms

Today, there are numerous applications and platforms designed to allow you to start investing with amounts as low as $5 or $10.

Some of the most recommended options, based on their ease of use and the proven experience of millions of users, are:

Acorns: This application rounds your purchases to the nearest dollar and uses the exchange rate to invest in diversified portfolios, making it ideal for those who are new to the world of finance.

Robinhood: Known for offering commission-free trading in stocks and ETFs, it is an attractive option for those who want to trade simply and without additional costs.

Stash: Aimed at financial education, Stash allows you to learn about investments while you invest, offering options suitable for different budgets and experience levels.

These platforms have been designed for people without extensive prior knowledge of finance, providing intuitive interfaces and educational resources that facilitate the understanding of basic investment concepts.

Simple strategies

To make the most of these opportunities, it is essential to follow some practical and proven strategies:

Define your financial goals: Set clear objectives, whether it’s saving to buy a home, planning for retirement or simply growing your savings. Having defined goals will help you select the investments that best suit your needs.

Diversify your portfolio: Don’t concentrate your resources in a single investment. Diversification through ETFs, mutual funds or a combination of different assets helps minimize risk and balance performance.

Invest regularly: Consistency is key. Even small periodic contributions, such as $20 a month, can make a big difference over time thanks to compound interest.

The magic of investing lies in repeated contributions over time. With discipline, even small amounts can generate big results

QuéOnnda.com

Final advices

Education is a fundamental pillar for investment success.

In addition to using accessible platforms, it is vital to get information from reliable sources.

Organizations such as the Hispanic Wealth Project offer free workshops, courses and resources that address everything from basic concepts to advanced strategies, tailored to the specific needs of the Hispanic community.

Researching and learning from financial experts will allow you to make informed decisions and reduce risk.