Saving money can be a challenge, but with the 50/30/20 method you could do it easily and effectively.

This approach, recommended by financial experts, is especially useful for the Hispanic community in the U.S., as it allows you to organize your income in a clear and efficient way. Find out how it works!

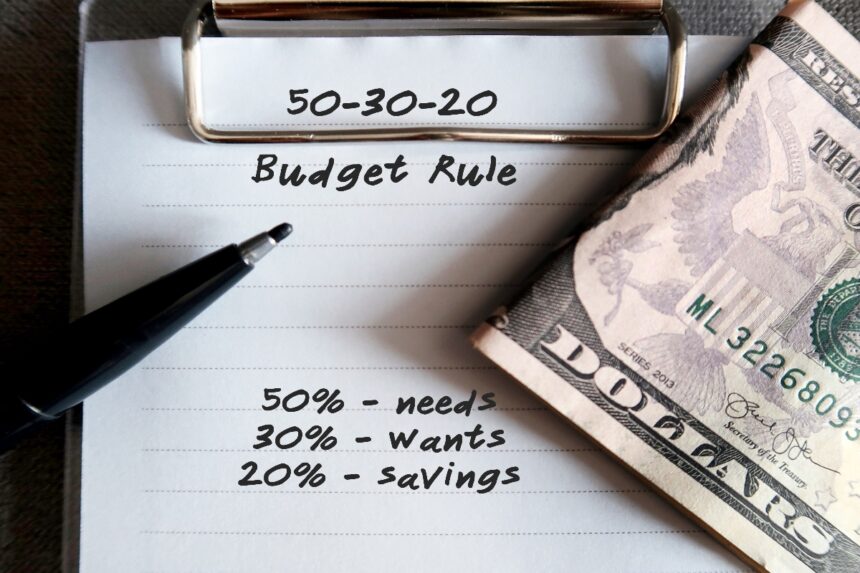

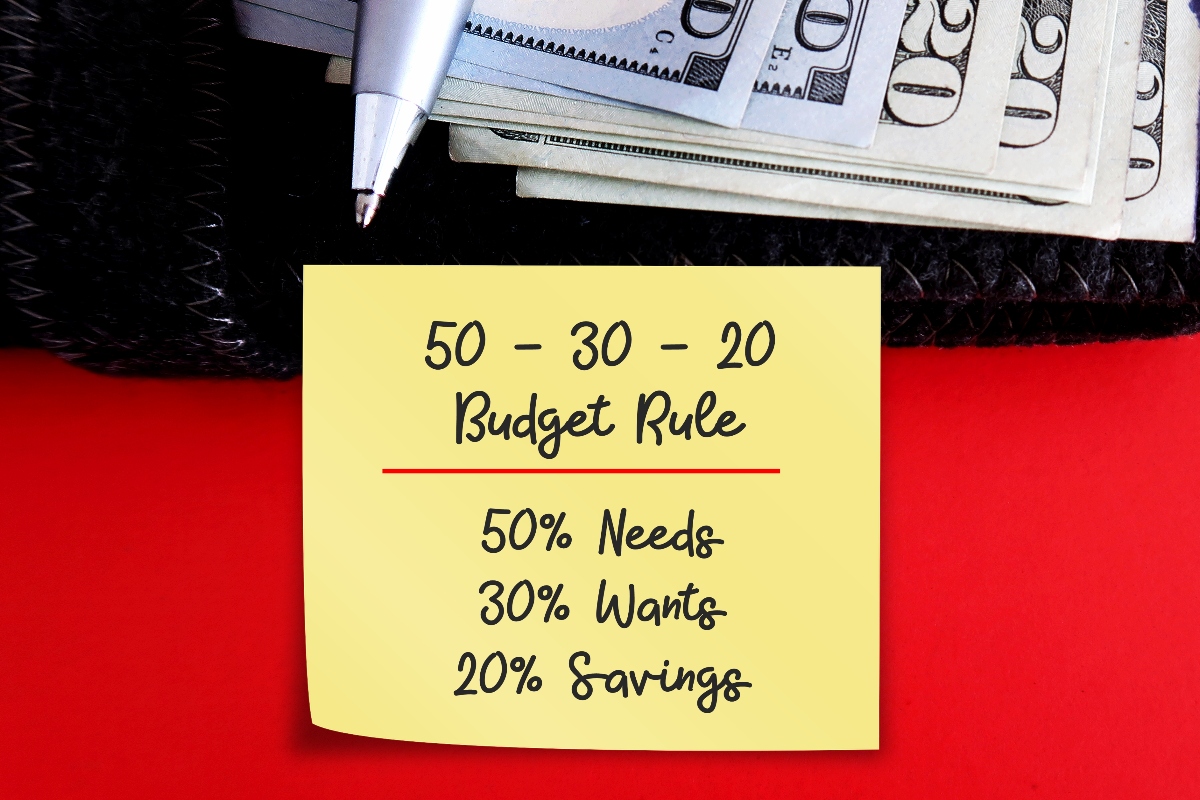

The 50/30/20 method

The 50/30/20 method divides your net income into three parts:

50% for necessities: Includes essential expenses such as rent, utilities, food and transportation.

30% for desires: Money for entertainment, outings or hobbies.

20% for savings and debt: An important part of building your financial future.

How to apply this method?

1. Calculate your net income: Subtract taxes and automatic deductions from your salary.

2. Divide your income: Use a spreadsheet or some useful applications such as EveryDollar to allocate each part.

3. Make adjustments: If your essential expenses exceed 50%, look for ways to reduce costs such as renegotiating contracts or switching to more economical options.

“The key is to adapt it to your personal situation. If you can’t save 20% right away, start with a smaller percentage and increase it gradually,” suggests Juan Perez, financial analyst.

Some benefits

The 50/30/20 method is ideal for those looking to balance their finances while supporting their families.

It also offers flexibility to accommodate cultural expenses, such as traditional celebrations or remittances.

This method helps you prioritize what's important without stopping enjoying life

Laura Rodríguez, asesora financiera certificada

To facilitate savings

There are free, easy-to-use resources that can help you implement this method.

Applications such as PocketGuard or Goodbudget offer automatic tracking and personalized advice.

“These tools make managing your finances more accessible, especially for those with variable incomes,” says Maria Lopez, a financial education expert.

To be taken into account

Divide your income: 50 percent needs, 30 percent wants and 20 percent savings.

2. Adjust your expenses: Cut back on non-essentials.

3. Use tools: They facilitate financial monitoring.

For more information, visit QuéOnnda.com.